Euro zone inflation fell to 1.8% in September, coming in below the European Central Bank’s 2% target, flash data from statistics agency Eurostat showed Tuesday.

The reading was in line with the expectations of economists polled by Reuters, after annual inflation hit a three-year-low of 2.2% in August.

The core inflation rate, which excludes more volatile energy, food, alcohol and tobacco prices, came in at 2.7%. It was forecast to remain unchanged from the August reading of 2.8%.

Services inflation in the euro zone eased to 4% in September, down from 4.1% in August, the data showed.

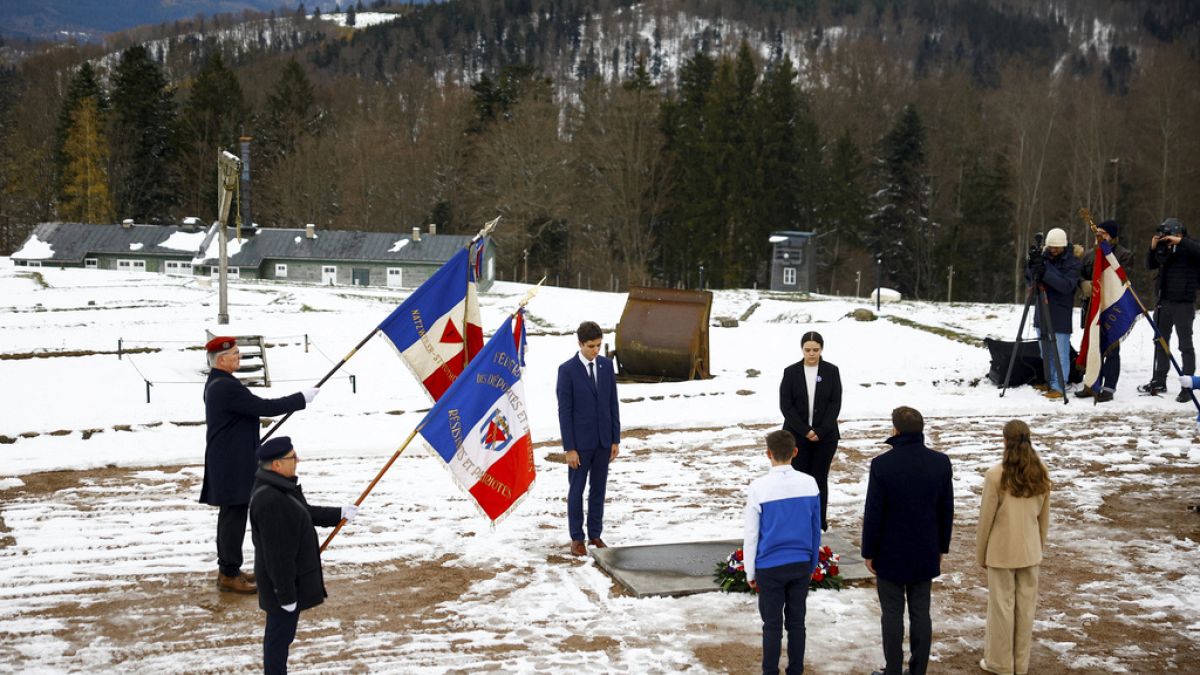

The figures come after September inflation eased below the 2% European Central Bank target in several key euro zone economies, including France and Germany. The harmonized inflation rate in Europe’s leading economy dropped by more than expected to 1.8% on an annual basis, preliminary data showed Monday.

European Central Bank President Christine Lagarde on Monday said that policymakers were becoming more confident about inflation returning to the 2% target.

“Looking ahead, inflation might temporarily increase in the fourth quarter of this year as previous sharp falls in energy prices drop out of the annual rates, but the latest developments strengthen our confidence that inflation will return to target in a timely manner,” she said at a hearing of the European Parliament’s Committee on Economic and Monetary Affairs.

“We will take that into account in our next monetary policy meeting in October,” Lagarde added. The ECB is next set to meet on Oct. 17.

Next ECB steps

Bank of America Global Research economists changed their expectations for the path ahead for ECB interest rate cuts following her comments, noting they are now anticipating a rate cut in October.

The economists had previously been forecasting that the central bank would hold rates steady this month, but now said that Lagarde’s comments “the same justification she used for the September cut,” which suggested a “a quasi-clear “go” for October.”

Deutsche Bank economists on Tuesday also moved up their forecast for the next ECB rate cut from December to October.

LSEG data showed that markets were widely pricing a 25-basis-point cut in October early on Tuesday.

Read the full article here