A tax proposal embraced by Vice President Kamala Harris that’s meant to target the wealthy is getting attention in an unlikely place for wonky policy debate: social media.

But many posts ignore the fact that the plan would only impact those whose net worth is more than $100 million, or less than 1% of taxpayers, and falsely suggest that all homeowners should fear a new massive tax bill. One TikTok user, for example, claimed that people will “lose their homes” and that “the IRS will bankrupt them.”

At issue is a proposal often referred to as a billionaire minimum tax. It would treat the increase in the value of assets – like real estate, stocks and private businesses – as taxable income each year, even if they are not sold. This is known as an unrealized capital gain.

One way to think of it is as a tax on a gain, or profit, that exists only on paper.

“It’s quite a transformational proposal,” said Mark Friedlich, vice president of government affairs at Wolters Kluwer Tax & Accounting.

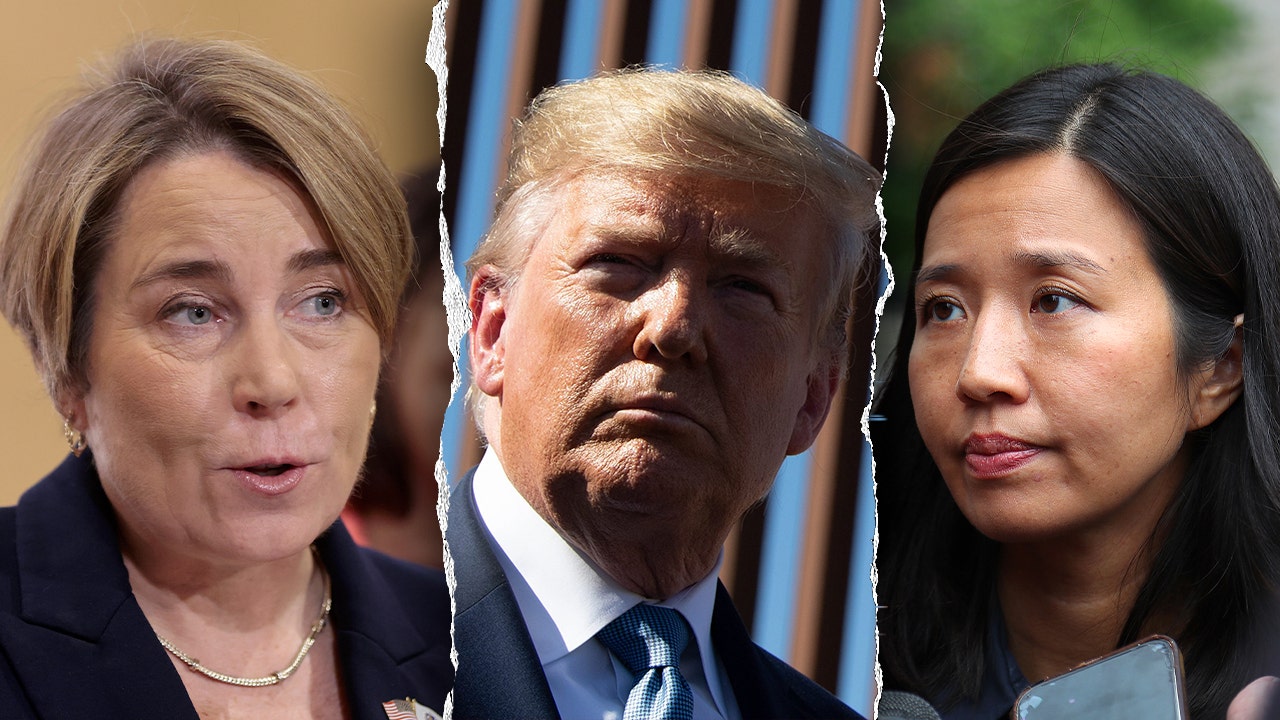

On the campaign trail, Harris has said she supports a billionaire minimum tax. She hasn’t outlined the specifics, but the Biden-Harris administration’s most recent budget proposal lays out details.

A billionaire minimum tax is one of several proposals pushed by Democrats in recent years to tax the rich. Both President Joe Biden and Harris have consistently said that they want to make the “wealthiest Americans pay their fair share” and that the additional tax revenue raised could be used to pay for social spending programs, like helping families pay for child care or down-payment help for first-time homebuyers.

Currently, some middle- and high-income people are subject to a tax on realized capital gains, which results when an asset – like a stock or home – is sold for more than what the owner originally paid for it. Essentially, it’s a tax on the profit. Harris has specifically called for raising the top tax rate on millionaires with long-term realized capital gains from 20% to 28%.

Here are key things to know about how these tax changes could work:

A billionaire minimum tax on unrealized capital gains would apply to taxpayers whose net worth is above $100 million, as proposed by the most recent Biden-Harris administration’s budget proposal.

To help put that in context, just 20,209 taxpayers – or about 0.01% – had net worth valued at $50 million or more in 2019, according to the latest IRS data available.

More recent data from Altrata, a private firm, suggests the number of high-net worth individuals has grown over the past five years. But the share of all US taxpayers earning more than $100 million is still likely to be small.

Harris’ proposal to increase the tax rate on realized capital gains to 28% would apply to taxpayers with income over $1 million. About 875,500 taxpayers – or 0.54% – reported having that much income in 2021, according to the IRS.

Those who would be impacted are “the smallest slice of the very wealthy,” said Erica York, a senior economist and research director at the right-leaning Tax Foundation.

Let’s discuss how a billionaire minimum tax – which is, on a basic level, a tax on unrealized capital gains – would impact a homeowner.

Currently, a homeowner pays a tax on the growth in the value of the home when it is sold, or realized. But a tax on unrealized capital gains would require a homeowner to pay a tax on the appreciated value of the home each year – even if the house hasn’t been sold.

For example, if a home was purchased for $500,000 and it appreciates in value to $520,000 the next year, the owner would owe some tax on the $20,000 increase.

The tax would also apply to other kinds of assets like stocks and private businesses. But again, the Biden-Harris administration’s proposal would only impact those whose net worth is more than $100 million.

Another misconception is about how much wealthy taxpayers would owe. It would not be a new, separate tax bill.

Under the Biden-Harris administration’s proposal, impacted taxpayers would be required to pay a minimum effective tax rate of 25% on all of their income – including unrealized capital gains. If their effective tax rate on this recalculated income amount fell below 25%, they would owe additional taxes.

To implement a tax on unrealized gains, the IRS would likely have to create a way to measure the change in value of a private business and real estate on an annual basis. The agency does not currently track these values.

“This creates an enormous administrative burden on the IRS, as if it’s not already challenged enough,” Friedlich said.

The new challenge could take away the agency’s core responsibilities of processing returns in a timely fashion and providing customer service help.

There could be ways to alleviate the burden on the IRS, depending on the details of the proposal. For example, a 2021 proposal from Senate Finance Committee Chairman Ron Wyden, an Oregon Democrat, would not have taxed non-tradable assets like real estate or businesses annually.

Even if Democrats control both the House and Senate during a potential Harris presidency, it may be hard to get the votes to pass the billionaire minimum tax or the increase to the long-term capital gains tax rate through Congress.

In 2021, Sens. Joe Manchin of West Virginia and Kyrsten Sinema of Arizona – both former Democrats who have since turned independent – blocked similar tax measures from moving forward.

If passed, a billionaire minimum tax – an unprecedented tax on income not yet received – would likely face many legal challenges.

Some critics of Democrats’ wealth tax proposals have suggested that people can’t trust that they would not eventually be expanded to middle-class households.

If history is any indication, there are examples to show that the government has both expanded and narrowed taxes after first implementing them. The federal income tax, for example, has expanded to more people over time. The impact of the estate tax, on the other hand, has narrowed.

Consistent with Biden’s policies, Harris has said nothing to suggest that she intends to raise taxes for people who earn less than $400,000 a year.

Harris hasn’t talked specifically about this, but there’s a provision in Biden’s budget that would change the way inherited assets are taxed.

Currently, you don’t have to pay a capital gains tax when you inherit a home, stocks or a business that have increased in value, thanks to a provision called “step-up in basis.”

But the Biden proposal would make some wealthy people pay that tax when an appreciated asset is passed on after death. The argument is that the step-up in basis primarily benefits the rich, whose wealth is more often tied up in real estate and stocks. It currently allows some wealth to avoid ever being taxed as it’s passed down from one family member to another.

Biden’s proposed change would only apply to inheritances where the appreciated value is worth more than $5 million for individuals or more than $10 million for married couples. Assets donated to charity would also be excluded from the tax.

Read the full article here