Vice President Kamala Harris called Wednesday for higher taxes on big-dollar investments like real estate and stocks during an appearance in New Hampshire — while floating plans for more deductions for small businesses.

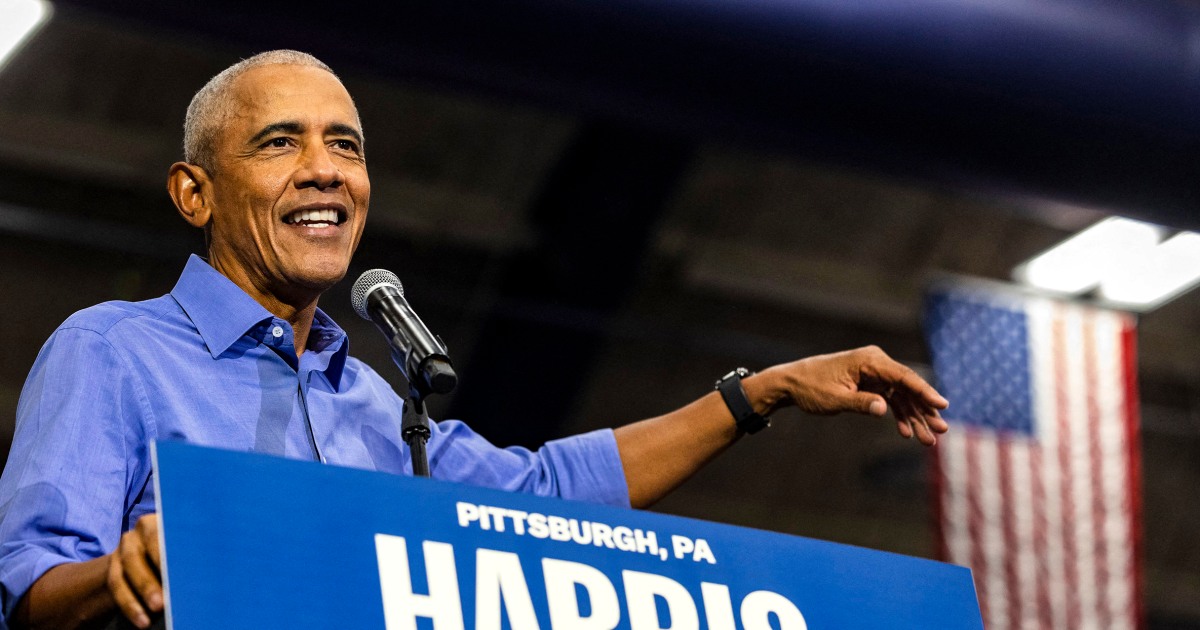

“If you earn a million dollars a year or more, the tax rate on your long-term capital gains will be 28% under my plan,” Harris told supporters in North Hampton, “because we know when the government encourages investment, it leads to broad-based economic growth and it creates jobs.”

The top capital gains tax rate currently is 20% — meaning the Democratic presidential nominee’s proposal amounts to a sizable hike for people who sell land or other holdings that have appreciated significantly in value.

The pitch by Harris, 59, calls for a more modest increase in capital gains taxes than a plan proposed by President Biden that called for top rates of 44.6% on investment income.

The veep did not directly mention Biden’s call for taxes on unrealized capital gains on top earners and a fact sheet released by her campaign also didn’t touch the idea — though Harris did say in her speech that “I support a billionaire minimum tax,” using terminology associated in the past with the plan.

Harris gave greater emphasis to other aspects of her tax policies, including boosting a federal tax deduction for business startup expenses from $5,000 to $50,000, while touting plans to cut red tape around business creation including attempting to simplify the tax-filing process.

“We will make it cheaper and easier for small businesses to file their taxes similar, similar to how individuals can take a standard deduction,” she said.

“Now I’m going to date myself again because they no longer do it, but kind of like, you remember the 1040EZ, like that kind of idea, right?” Harris went on, describing a form last used in 2017.

“Like, let’s just take away some of the bureaucracy in the process to make it easier for people to actually do something that’s going to benefit our entire economy.”

The Democrat did not mention her support for eliminating taxes on tipped income — an idea she embraced last month that initially was advanced by Republican presidential nominee Donald Trump, who has suggested Harris wouldn’t actually get the plan enacted if elected.

Trump, 78, has also proposed the elimination of taxes on Social Security income if he retakes the White House, an idea Harris has not embraced.

The vice president devoted some of her speech to bashing the 45th president’s threat to levy tariffs of up to 10% on foreign goods — calling it a “national sales tax on everyday products and basic necessities.”

Trump used the threat of tariffs as a negotiating tactic during his four-year term of office and those he did implement, including on Chinese goods as well as steel and aluminum products from many foreign countries, have either been kept in place or increased by Biden and Harris.

Harris did not specifically address the fate of Trump’s 2017 tax cuts that permanently lowered the corporate tax rate from 39% to 21% and temporarily lowered individual income taxes.

The lower rates for individual filers expire next year.

Read the full article here